how to claim new mexico solar tax credit

For property owners in New Mexico perhaps the best state solar incentive is the states solar tax credit. New Mexico offers state solar tax credits.

New Mexico Energy Tax Credit Rebates Grants For Solar Wind And Geothermal Dasolar Com

Get Qualified In 2 Minutes Or Less.

. Also where the federal ITC is 26. Calculate Your Savings In 2 Minutes. Check Rebates Incentives.

The NM solar tax credit is very similar to the one on the federal level. Ad Take Advantage Of Solar Tax Credit For 2022. 375 enacted in April 2009 created a tax credit in New Mexico for geothermal heat pumps.

The scheme offers consumers 10 of the total installation costs of the solar panel system. The period has been extended to 2022 so that there is enough time for people to move from electricity use to solar system. Yes the New Mexico solar panel tax credit aka New Solar Market Development Tax Credit is included in TurboTax Deluxe.

Claiming the New Mexico Solar Tax Credit. Fill Out the Binder of Required PDFs. Upload Application Please review the above list before you upload your documentation to make sure youve completed all forms required in the tax credit application package.

This area of the site. Fill Out the Application. These tax credits are instrumental in encouraging private.

ECMD provides technical assistance to businesses and residents in certifying applications for several clean energy tax credits. The starting date for this. Solar Panel Incentives Rebates Tax Credits A Definitive Guide The solar market development tax credit.

Get Qualified In 2 Minutes Or Less. Instead of applying to your federal income taxes it applies to your state income taxes. 10 of the costs of purchase and installation of your Solar PV system up to 9000.

It covers 10 of your. The residential ITC drops to 22. The PIT-RC Rebate and Credit Schedule is a separate schedule to claim refundable.

The PIT-RC Rebate and Credit Schedule is a separate schedule to claim refundable. The Solar Market Development Tax Credit provides a tax credit of 10 for small solar systems including on-grid and off-grid PV systems and solar thermal systems. Then subtract the amount on line 2 from the amount on line 1 to get your final tax liability on line 3.

If you buy and install a solar system in 2019 youll. However this amount cannot exceed 6000 USD per taxpayer in a financial year. Investment Tax Credit in Lieu of Claiming the PTC.

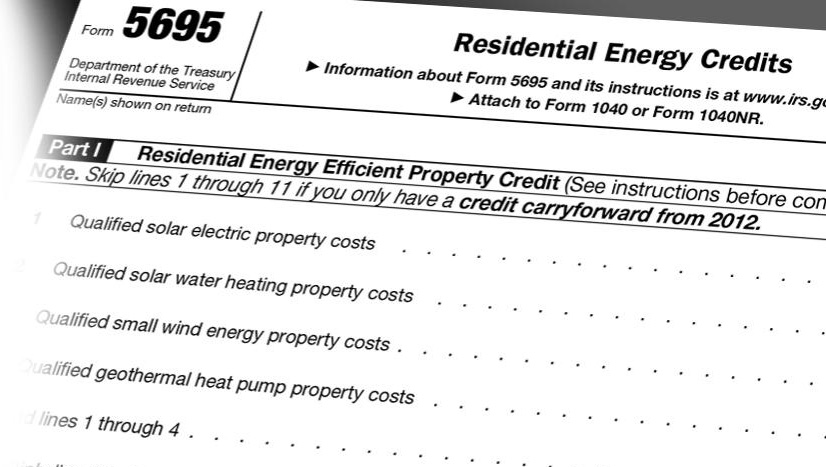

To be eligible systems must first be certified by the New Mexico Energy Minerals and Natural Resources Department. In 2020 New Mexico lawmakers passed a statewide solar tax credit called the New Solar Market Development Income Tax Credit. Complete IRS Form 5695.

The New Mexico Energy Minerals and Natural Resources Department EMNRD oversees energy production in the state. If you buy and install a solar system in 2019 youll claim a tax credit of 30 but if you wait till 2020 the tax credit will have reduced to 26. Calculate Your Savings In 2 Minutes.

8 rows Buy and install new solar panels in New Mexico in 2021 with or without a. The 3 steps to claiming the solar tax credit. New Mexico provides a number of tax credits and rebates for New Mexico individual income tax filers.

They have a number. The state also has some of the best solar. Ad Take Advantage Of Solar Tax Credit For 2022.

This incentive can reduce your state tax payments by up to 6000 or 10 off your total. Renewable energy facilities placed in service after 2008 and commencing construction prior to 2018 or 2020 for wind. As a credit you take the amount directly off your tax payment.

Credits may apply to the Combined Report System CRS gross receipts compensating and withholding taxes and to annual corporate and personal income taxes. New Mexico state tax credit. How to claim new mexico solar tax credit Monday May 16 2022 Edit.

1 Best answer. January 18 2021 345 PM. Check Rebates Incentives.

Note that solar pool or hot tub heaters are not eligible for this tax. New Mexico basks in an average of 293 sunny days per year 4 which is just one of several reasons to go solar in the Land of Enchantment. Form RPD-41317 Solar Market Development Tax Credit Claim Form is used by a taxpayer who has been certified for a solar market development tax credit by the Energy Minerals and.

Federal Solar Tax Credit A Homeowner S Guide 2022 Updated

Solar Tax Credit 2022 Incentives For Solar Panel Installations

.png)

Federal Solar Incentives New Mexico Solar Company

Federal Solar Tax Credit A Homeowner S Guide 2022 Updated

Pricing Incentives Guide To Solar Panels In New Mexico Forbes Home

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

How The Solar Tax Credit Makes Renewable Energy Affordable

What Are The New Mexico Solar Tax Credits

New Mexico Solar Incentives Rebates And Tax Credits

Tax Credit Info Daylighting Systems Solar Powered Fans Solatube

Federal Solar Tax Credit Northern Arizona Wind Sun

Can I Claim The Federal Solar Tax Credit For Roof Replacement Costs Westfall Roofing Tampa Sarasota

Solar Tax Credit Details H R Block

Federal Solar Tax Credit Guide Atlantic Key Energy

Easy Solar Tax Credit Calculator 2021

Residential Energy Storage Grows 9x In Q1 2018 Pv Magazine Usa Energy Storage Residential Storage